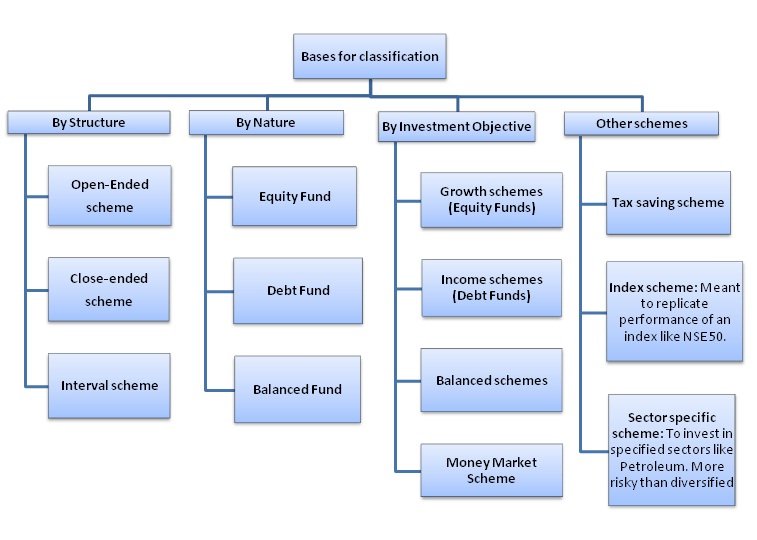

By Structure

a) Open-ended Scheme: These are the schemes in which units are available for subscription throughout the year and have no fixed maturity period. Such units can be bought or sold conveniently at NAV related prices of the Fund.

b) Close-ended Scheme: The units of these schemes have a pre-specified maturity period. The units may be bought at initial offering. However, atleast one of the following exit route is made available to unit holders:

i) Exit through sale on Stock Exchange.

ii) Exit through sale to Mutual Fund itself through its periodic repurchase scheme.

c) Interval Scheme: These schemes are flexible and have features of both open ended as well as close ended schemes.

By Nature

a) Equity Fund:These are the funds which invest their maximum part of corpus in equity holdings. The structure of such funds varies from scheme to scheme. Broadly, Equity Schemes are of following types:

i) Large-Cap Funds: The proceeds of the fund are invested in companies with large market capitalization. These funds offer a secure and stable income.

ii) Mid-Cap Funds: The proceeds of the fund are invested in mid-size companies which are considered as still developing and offering wider scope of income with relatively higher risk.

iii) Sector Specific: Such funds tend to invest in some strategically chosen sectors like IT, Pharmaceutical, Power etc.

iv) Tax Saving: These are the funds set up to offer various tax rebates / deductions to the investors under section 80C of the Income TAx Act,1961. One such Tax Saving Fund is fund set up under Equity Linked Saving Scheme notified u/s 80C(2)(xiii). Further, investment in Mutual Fund approved by CBDT u/s 80C(2)(xx) (Read with Rule 20A) is also eligible for the deduction.

b) Debt Fund:These funds are invested in debt papers or securities of Government authorities, private companies, banks, financial institutions etc. Though they are not considered for tax benefits but the high returns and low risk attract investors to put their money in various Debt Fund Schemes. A few of such schemes are discussed below:

i) Gilt Funds: Their objective is to invest money in Government securities or securities backed by Government, which carry zero default risk but have interest rate risk which provides medium but stable income.

ii) Income Fund: These funds invest in different debt securities of corporate debentures, bonds, Government securities and money market instruments. The investment bears high risk but the return comes out to be good when a constant check is made on the market price of such units.

iii) Monthly Income Plans: These are hybrid kind of debt mutual fund which invests a small proportion of their corpus in equity as well. The investor enjoys the benefit of diversification with the low or medium risk but relatively higher returns.

iv) Liquid Funds: These are highly liquid instrument of Money Market Schemes like Treasury Bills, CPs, CDs etc. The investment tenure may vary from even a single day to 3 months. Big Corporate houses with surplus cash use this fund for short-term cash management purposes. This scheme is considered to be the safest of all on risk-return matrix.

c) Balanced Funds: They are the mix of both equity and debt funds and provides investors best of both the types of Funds as the Equity Part provides growth and Debt part provides stability in returns. .

To know about taxability of Mutual Funds, Please click here.