As per section 194IA, the buyer of the immovable property will be liable to deduct TDS on any sum paid or payable as consideration to the resident seller at the rate of 1% on the date of payment/ credit whichever is earlier. The said section will be applicable only if such consideration is 50 Lakhs or more. Such TDS u/s 194IA will be deposited within 30 days from the end of the month in which deduction has been made.

However, there is no limit on number of buyers or sellers for purchase of property. In sense, if the consideration of the property is 50 Lakhs or more, the buyers will be liable to deduct and deposit TDS on their specific shares. This section is made property wise and not buyer or seller wise.

Here, immovable property shall mean and include all properties irrespective of their intended purpose of use or their level of construction (other than agricultural land)

WHAT WILL BE TREATMENT OF TDS IN CASE THE BUYER HAS TAKEN HOME LOAN REGARDING PURCHASE OF PROPERTY?

One case which is really general in nature is the involvement of bank i.e. when the buyer takes home loan for the purchase of property. However, the law doesn’t state any other third party in the transaction but it is quite common. In such a case, specifically the buyer will be liable to deduct TDS and not the bank as the section lays the responsibility to deduct TDS on buyer and not on any third party like bank.

As in section, it is stated that “any person, being a transferee…”

Bank can’t be said to be transferee even if it is providing funds to the buyer.

Therefore, the whole TDS will be deducted by the buyer from the amount paid by him to seller and the bank will not be held responsible to deduct TDS on payment made by him on buyer’s behalf.

For Example

If A wants to purchase a property of Rs. 60,00,000/- and he has Rs. 15,00,000/- with him, the remaining amount of Rs. 45,00,000/- is financed by a bank as home loan. Now,

TDS to be deducted and deposited by A = Rs. 60,00,000 x 1%

= Rs. 60,000/-

Now, Rs. 15,00,000/- will be given by A to seller but as per home loan terms, Rs. 45,00,000/- will be given by bank to seller. However, in this case, bank is not responsible or will not deduct TDS of seller. But it is A’s responsibility to deduct TDS. Therefore, A will pay

Payment by A to seller = Rs. 15,00,000 (A’s amount) – Rs. 60,000 (TDS)

= Rs. 14,40,000/-

In the end, seller will receive total amount of Rs. 59,40,000/- comprising of Rs. 45,00,000/- from bank and Rs. 14,40,000/- from A.

One more point here is to be noted that TDS will be deducted when the payment is made to the seller either one time or in instalments. Let say, if this Rs. 60,00,000/- is paid in 4 instalments, each and every time, TDS would have to be required to be deducted.

In that case, each instalment will be of Rs. 14,85,000/- (RS. 15,00,000- Rs. 15,000) after deducting TDS.

CONCLUSION:

It can be concluded that section 194IA is payment centric for deduction of Tax but for its applicability total consideration of property is to be checked irrespective of the fact when and how much the payment has been done.

PROCESS FOR PAYMENT OF TDS U/S 194IA

The law exempts such tax payers from the requirement of TAN. Now, the question arises, how will they deposit such tax to government and how the credit will be claimed?

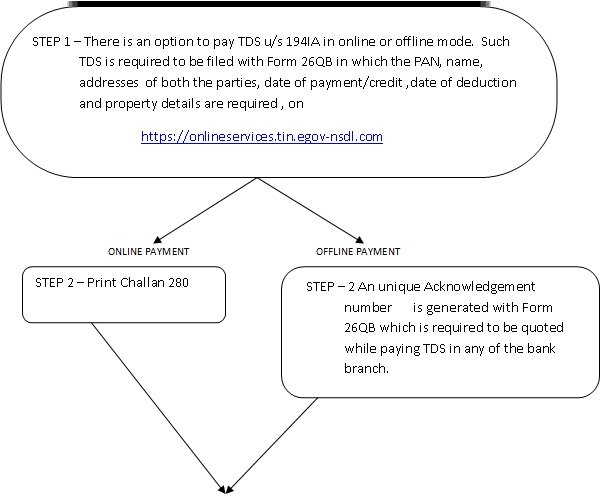

There is a simplified process for such deposit of TDS which is shown in the flowchart below :

By CA Harshita Gupta