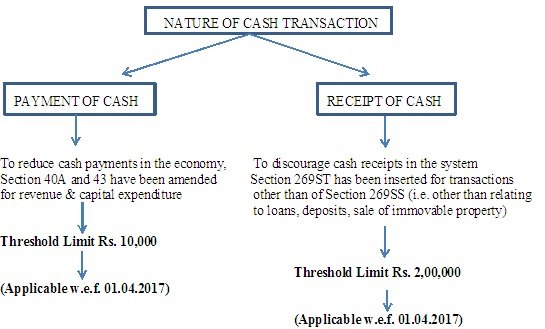

In India, the quantum of domestic black money is huge which adversely affects the revenue of the government creating a resource crunch for its various welfare programmes. Black money is generally transacted in cash and large amount of unaccounted wealth is stored and used in form of cash. In order to achieve the mission of the government to move towards a cash less economy to reduce generation and circulation of black money, various sections in the Income Tax Act, 1961 have been inserted to curb cash transactions.

Following is the detailed analysis of the new amendments:

1. Disallowance of revenue expenditure under Section 40A(3):

- Sub-section (3) of Section 40A of the Act, provides that any expenditure in respect of which payment or aggregate of payments made to a person in a day, otherwise than by banking means, exceeds ten thousand rupees, such expenditure shall not be allowed as a deduction. (except in specified circumstances as referred to in Rule 6DD of the Income-tax Rules, 1961)

- Deeming a payment as profits and gains of business or profession if the expenditure is incurred in a particular year but the payment is made in any subsequent year of a sum exceeding ten thousand rupees otherwise than by banking means.

1. Explanation: According to the provision, if an assessee makes a payment of any amount exceeding Rs. 10,000/- in cash to any person in a single day for any expenditure, then such sum shall not be allowed as deduction in computation of Income from “Profits and gains of business or profession”.

The allowable mode of payment above Rs. 10,000 are account payee cheque or account payee bank draft or payment through electronic clearing system through a bank account or through such other electronic modes.

- Credit Card

- Debit Card

- Net Banking

- IMPS (Immediate Payment Service)

- UPI (Unified Payment Interface)

- RTGS (Real Time Gross Settlement)

- NEFT (National Electronic Funds Transfer), and

- BHIM (Bharat Interface for Money) Aadhaar Pay”

2. Disallowance of depreciation under Section 32:

Section 43 of the Act disallows the capital expenditure incurred in cash. For Instance, purchase of Fixed Assets.

As per this section,, any expenditure incurred by the assessee for acquisition of any asset in respect to which a payment or aggregate of payments made to a person in a day, otherwise than by banking means, equals or exceeds ten thousand rupees, such expenditure shall be ignored for the purposes of determination of actual cost of such asset.

Explanation: According to this provision, if an assessee makes a payment of any amount equal to or exceeding Rs. 10,000/- in cash to any person in a single day for any expenditure towards acquisition of any asset, then such sum shall not be included in the cost of the asset, and the assessee will not be able to claim depreciation on such amount.

Therefore, now an assessee cannot make a payment of any sum of Rs. 10,000 or more in a day towards purchase of any fixed asset.

3. Section 269SS & Section 269ST:

- Section 269SS of the Income Tax Act 1961, states that no person shall accept from any person any loan or deposit or any sum of money, whether as advance or otherwise, otherwise than by an account payee cheque or account payee bank draft or by electronic clearing system through a bank accountor through such other electronic mode, if the amount of such loan or deposit or such specified sum is twenty thousand rupees or more.

- Section 269ST has been inserted in the Income Tax Act, 1961 to provide that no person shall receive an amount of two lakh rupees or more, —

(a) in aggregate from a person in a day;

(b) in respect of a single transaction; or

(c) in respect of transactions relating to one event or occasion from a person, otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account or through such other electronic mode

Transactions of the nature referred to in Section 269SS are excluded from the scope of the said section.

Further, Section 271DA in the Act provide for levy of penalty on a person who receives a sum in contravention of the provisions of the section 269ST. The penalty is a sum equal to the amount of such receipt.

Explanation

- Section 269SS of Income Tax Act, 1961 states that no person shall accept or take (receive) cash from any other person as

- loan or

- deposit or

- as advance or otherwise

if such sum of cash is equal to or exceeds Rs. 20,000.

- Section 269ST states that no person shall receive an amount of Rs. 2 Lakhs or more in aggregate from a person in a day for a single transaction in cash.

- Therefore, for transactions of loan or deposit under Section 269SS, the limit of Rs. 20000 shall apply whereas for transactions other than those of Section 269SS, limit of Rs. 2 Lakhs shall apply.

- If a person receives Rs. 2 Lakhs or more in cash as stated above, then, a penalty of equal amount of such receipt under Section 271DA shall be levied on such person who is receiving the amount.

- Hence, it can be concluded that due to operation of the section 269ST:

- No cash sales of Rs. 2 Lakhs or more in a single bill can be made to any person.

- No amount of Rs. 2 Lakhs or more can be received for a single transaction.

- No amount of Rs. 2 Lakhs or more can be received from a person in cash which is related to one event or occasion.

Following can be extracted from the above:

- An individual can purchase an asset in personal nature in cash upto 2 Lakhs.

- A concern can purchase a capital asset in cash only upto 10,000.

- No transaction of sale/ purchase above Rs. 2 Lakhs can be made in cash.Any payment for revenue expenditure can be made in cash only upto 10,000 in aggregate to a person in a day.

- Cash Gifts can be received upto Rs. 2 Lakhs by any person.