Establishing a Delaware LLC with foreign or non-resident ownership offers significant global business opportunities, but it also comes with clearly defined regulatory and tax obligations. A thorough understanding of these requirements—spanning U.S. federal taxation, state-level compliance, and cross-border reporting—is essential to maintain ongoing compliance and good standing.

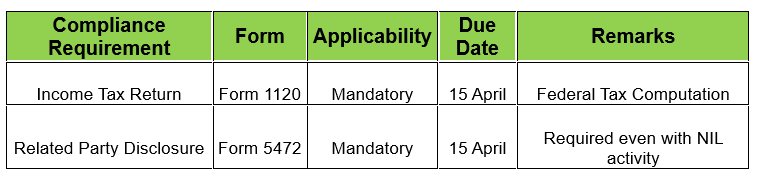

1. U.S. Federal Compliance (IRS)

Understanding the U.S. Tax Position

A single-member LLC owned by a non-resident is treated as a disregarded entity for U.S. federal income tax purposes. Accordingly, the LLC itself is not regarded as a separate taxpayer for U.S. income tax. However, for income tax compliance and reporting purposes, the LLC is generally treated as a corporation.

Irrespective of whether the LLC earns income or remains dormant, information reporting obligations apply in all cases. Even in situations where there is no revenue and only internal funding or expense reimbursements exist, the Internal Revenue Service (IRS) mandates disclosure of transactions between the U.S. LLC and its foreign owner.

Reportable Transactions

Transactions that must be reported include, but are not limited to:

• Capital contributions made by the non-resident holding company

• Reimbursement of expenses

• Management fees or service charges

• Loans, advances, or repayments

It is important to note that even a single financial transaction during the financial year triggers the reporting requirement.

Federal Compliance Requirements

Important Note:

Failure to file Form 5472 can attract a minimum penalty of USD 25,000 per year, even where no tax is payable in the United States.

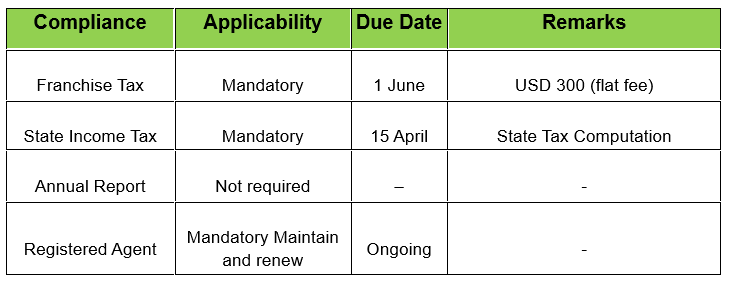

2. Delaware State Compliance

Understanding Delaware Requirements

In addition to U.S. federal compliance requirements mentioned above, every LLC is also required to adhere to the laws and regulations of the state in which it is incorporated. Delaware primarily regulates entity formation, registration, and maintenance, rather than income-based taxation. For Delaware LLCs, the compliance framework is relatively simple:

• No annual report is required for LLCs

• The principal annual obligation is payment of the Delaware franchise tax

• Maintaining a registered agent in Delaware is mandatory at all times

Delaware Compliance Requirements

3. Indirect Taxes – Service Sector

Understanding Indirect Tax Exposure

Delaware is a no-sales-tax state. Mere incorporation in Delaware or providing services remotely does not, by itself, create any indirect tax liability.

Key Takeaways

• Form 5472 is the most critical annual compliance requirement for foreign-owned U.S. LLCs

• Compliance obligations apply even in dormant years or cost-only years

• Proper documentation of inter-company transactions is essential for audit and regulatory purposes

• Delaware compliance is largely administrative, with limited recurring obligations

Further Reading

For a deeper understanding of the subject, you may refer to the following resources on our website:

- US Income Taxation in India – KL Aggarwal

- Delaware, US tax laws – KL Aggarwal

- Taxation of LLC in US formed by Indian Residents – KL Aggarwal

Should you wish to know more on Delaware Company Incorporation, please click here

For queries, you can reach us at mail@klaggarwal.com